* | * Less than 1%

FORTUNE BRANDS INNOVATIONS•2024 PROXY STATEMENT

| Certain Information Regarding Security Holdings | 63 |

(1)Includes the following number of shares with respect to which the NEOs have the right to acquire beneficial ownership within 60 days after March 8, 2024:

| | (1) | | | | Name | Includes the following number

| Number

of shares with respect to which the NEOs have the right to acquire beneficial ownership within 60 days after March 4, 2022:

Shares |

|

|

|

|

| David V. Barry |

|

| 17,515 |

|

| Hiranda S. Donoghue |

|

| 10,644 |

|

| Nicholas I. Fink |

|

| 462,399 |

|

| Sheri R. Grissom |

|

| 119,912 |

|

| Cheri M. Phyfer |

|

| 76,824 |

|

|

| | | | | Name

| | Number

of

Shares | | R. David Banyard, Jr.

| | | 31,500 | | Robert K. Biggart

| | | 139,144 | | Nicholas I. Fink

| | | 236,462 | | Brett E. Finley

| | | 68,795 | | Patrick D. Hallinan

| | | 131,146 | | Cheri M. Phyfer

| | | 28,789 | |

(2)In a report filed by BlackRock, Inc. (“BlackRock”) on Schedule 13G/A filed on January 23, 2024, BlackRock disclosed that as of December 31, 2023, it and its subsidiaries had sole voting power over 14,132,607 shares, shared voting power over no shares, sole dispositive power over 15,143,529 shares, and shared dispositive power over no shares. The principal business address of BlackRock, Inc., is 50 Hudson Yards, New York, New York, 10001.

| (2) | In a report filed by The Vanguard Group (“Vanguard”) on Schedule 13G/A filed on February 10, 2022, Vanguard disclosed that as of December 31, 2021, it and its wholly owned subsidiaries specified therein had sole voting power over no shares, shared voting power over 219,914 shares, sole dispositive power over 14,020,419 shares, and shared dispositive power over 556,693

(3)In a report filed by The Vanguard Group (“Vanguard”) on Schedule 13G/A filed on February 13, 2024, Vanguard disclosed that as of December 31, 2023, it and its wholly owned subsidiaries specified therein had sole voting power over no shares, shared voting power over 81,835 shares, sole dispositive power over 12,105,451 shares, and shared dispositive power over 282,062 shares. The principal business address of Vanguard is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (3) | In a report filed by FMR LLC (“FMR”) on Schedule 13G filed on February 9, 2022, FMR disclosed that as of December 31, 2021, it and its wholly owned subsidiaries specified therein had sole voting power over 3,428,021 shares, shared voting power over no shares, sole dispositive power over 13,904,534 shares, and shared dispositive power over 0 shares. The principal business address of FMR is 245 Summer Street, Boston, Massachusetts 02210. Abigail P. Johnson is a Director, the Chairman and the Chief Executive Officer of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in

|

| CERTAIN INFORMATION REGARDING SECURITY HOLDINGS (CONTINUED)

|

| accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. |

| (4) | In a report filed by BlackRock, Inc. (“BlackRock”) on Schedule 13G/A filed on February 3, 2022, BlackRock disclosed that as of December 31, 2021, it and its subsidiaries had sole voting power over 9,756,717 shares, shared voting power over no shares, sole dispositive power over 11,010,606 shares, and shared dispositive power over no shares. The principal business address of BlackRock, Inc., is 55 East 52nd Street, New York, New York, 10055.

|

| (5) | In a report filed by JPMorgan Chase & Co. (“JPMorgan”) on Schedule 13G/A filed on January 21, 2022, JPMorgan disclosed that as of December 31, 2021, it and its wholly owned subsidiaries had sole voting power over 7,499,835 shares, shared voting power over 16,649 shares, sole dispositive power over 7,710,348 shares and shared dispositive power over 19,964 shares. The principal business address of JPMorgan is 383 Madison Avenue, New York, New York 10179.

|

| (6) | Includes 6,336 shares which Mr. Banyard has deferred until his retirement.

|

| (7) | Includes 940 shares held by trusts for the benefit of Mr. Fink’s heirs for which Mr. Fink has a pecuniary interest.

|

| (8) | Includes 34,815 shares which Ms. Hackett has deferred until the January following the year in which she ceases to be a member of the Board pursuant to the Non-Employee Director Deferred Compensation Plan.

|

| (9) | Includes 28,685 shares held by trusts for the benefit of Mr. Hallinan’s heirs for which Mr. Hallinan has sole investment power.

|

| (10) | Includes 8,000 shares held by trusts for which Mr. Mackay has sole investment power; however, he disclaims beneficial ownership of such shares.

|

| (11) | Includes 5,742 shares which Mr. Morikis has deferred until the January following the year in which he ceases to be a member of the Board pursuant to the Non-Employee Director Deferred Compensation Plan.

|

| (12) | Includes 2,914 shares which Mr. Thomas has deferred until the January following the year in which he ceases to be a member of the Board pursuant to the Non-Employee Director Deferred Compensation Plan. Also includes 6,755 shares held by a charitable organization for which Mr. Thomas has sole investment and voting power; however, he disclaims beneficial ownership of such shares.

|

| (13) | Includes 12,409 shares held by a trust for which Mr. Waters’ spouse has sole investment power.

|

| (14) | The table includes 779,464(4)

Includes 2,479 shares held through the Company's retirement savings plan. (5)Includes 4,823 shares which Mr. Finan has deferred until the January following the year in which he ceases to be a member of the Board pursuant to the Non-Employee Director Compensation Plan. (6)Includes 5,828 shares held by trusts for the benefit of Mr. Fink’s heirs for which Mr. Fink has a pecuniary interest and 75,298 shares held by grantor in retained annuity trusts. (7)Includes 20,851 shares which have been deferred by Ms. Grissom. (8)Includes 34,815 shares which Ms. Hackett has deferred until the January following the year in which she ceases to be a member of the Board pursuant to the Non-Employee Director Deferred Compensation Plan. (9)Reflects Mr. Hallinan's beneficial ownership of Company stock held as of the date of his retirement (March 8, 2023) and represents 52,584 shares held directly by him and indirectly by trusts controlled by him, 41,908 restricted stock units that were vested but not yet settled and 244,836 exercisable stock options that he had the right to acquire on such date. (10)Includes 5,742 shares which Mr. Morikis has deferred until the January following the year in which he ceases to be a member of the Board pursuant to the Non-Employee Director Deferred Compensation Plan. (11)Includes 12,409 shares held by a trust for which Mr. Waters’ spouse has sole investment power. (12)The table includes 1,242,648 shares of which our directors and executive officers as a group had the right to acquire beneficial ownership within 60 days after March 4, 2022. Inclusion of such shares does not constitute an admission by any director or executive officer that such person is the beneficial owner of such shares. |

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, certain officers and beneficial owners of more than ten percent of our outstanding common stock to file initial reports of beneficial ownership on Form 3, and reports of subsequent changes in beneficial ownership on Forms 4 or 5, with the SEC. Based solely on a review of these forms and certifications from our directors and executive officers we believeas of March 8, 2024, as a group, had the right to acquire beneficial ownership within 60 days after March 8, 2024. Inclusion of such shares does not constitute an admission by any director or executive officer that all directors and officers subject to Section 16 complied withsuch person is the filing requirements applicable to them for the fiscal year ended December 31, 2021, with one exception. Due to a delay in obtaining the SEC filing code, a Form 4 reporting the grantbeneficial owner of 9,255 shares to Hiranda Donoghue was not timely reported. A Form 4 reporting the transaction was filed one day late on December 16, 2021.such shares.

FORTUNE BRANDS INNOVATIONS•2024 PROXY STATEMENT

| FREQUENTLY ASKED QUESTIONS

Frequently Asked Questions | 64 |

Frequently Asked Questions Why did I receive these materials? This Proxy Statement describes the matters on which you, as a stockholder, are entitled to vote on at the Company’s Annual Meeting and gives you the information that you need to make an informed decision on these matters. Why did I receive a “Notice of Internet Availability of Proxy Materials” instead of printed proxy materials? Companies are permitted to provide stockholders with access to proxy materials over the Internet instead of mailing a printed copy. Unless we were instructed otherwise, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to stockholders. The Notice contains instructions on how to access the proxy materials on the Internet, how to vote and how to request a printed set of proxy materials. This approach reduces the environmental impact and our costs of printing and distributing the proxy materials, while providing a convenient method of accessing the materials and voting. The Company will make its Annual Report on Form 10-K for the last fiscal year, including any financial statements or schedules, available to stockholders without charge, upon written request to the Secretary, Fortune Brands Home & Security, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015.

Can I get electronic access to the proxy materials if I received printed materials? Yes. If you received printed proxy materials, you can also access them online at www.proxyvote.com before voting your shares. The Company’s proxy materials are also available on our website at https://ir.fbhs.com/ir.fbin.com/annual-reports-and-proxies. Stockholders are encouraged to elect to receive future proxy materials electronically. If you opt to receive our future proxy materials electronically, you will receive an email next year with instructions containing a link to view those proxy materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it or for as long as the email address provided by you is valid. Stockholders of record who wish to participate can enroll at http://enroll.icsdelivery.com/fbhsfbin. If your shares are held in an account by a bank, broker or other nominee, you should check with your bank, broker or other nominee regarding the availability of this service. What is the difference between being a stockholder of record and a beneficial owner? If your shares are registered directly in your name with EQ Shareholder Services, the Company’s transfer agent, you are the “stockholder of record.” If your shares are held in an account by a bank, broker or other nominee, you hold your shares in “street name” and are a “beneficial owner” of those shares. The majority of stockholders are beneficial owners. For such shares, a bank, broker or other nominee is considered the stockholder of record for purposes of voting at the Annual Meeting. Beneficial owners have the right to direct their bank, broker or other nominee on how to vote the shares held in their account by using the voting instructions provided by the bank, broker or other nominee. Who is entitled to vote? Only stockholders who owned the Company’s common stockCommon Stock of record at the close of business on March 4, 20228, 2024 (the “record date”) are entitled to vote. Each holder of common stockCommon Stock is entitled to one vote per share. There were 132,346,750125,701,330 shares of common stockCommon Stock outstanding on the record date. | FREQUENTLY ASKED QUESTIONS (CONTINUED)

|

Who can attend the Annual Meeting? Only stockholders who owned Fortune Brands’ common stockCommon Stock as of the close of business on the record date, or their authorized representatives, may attend the Annual Meeting. At the entrance to the meeting, stockholders will be asked to present valid photo identification to determine stock ownership on the record date. If you are acting as a proxy, you will need to submit a valid written legal proxy signed by the owner of the common stock.Common Stock. You must bring such evidence with you to be admitted to the Annual Meeting.

FORTUNE BRANDS INNOVATIONS•2024 PROXY STATEMENT

| Frequently Asked Questions | 65 |

Stockholders who own their shares in “street name” will be required to submit proof of ownership at the entrance to the meeting. Either your voting instruction card or brokerage statement reflecting your stock ownership as of the record date may be used as proof of ownership. The Company is actively monitoring COVID-19monitors public health developments and related guidance issued by public health authorities. If it is determined that it is advisable or required, the Company may hold a virtual-only annual meeting via live webcast. If this step is taken, the Company will announce the decision to do so in advance and details on how to participate will be posted on the Company’s website and filed with the SEC as additional proxy materials. How do I vote? If you received a Notice in the mail, you can either vote by (i) Internet (www.proxyvote.com) or (ii) in person at the Annual Meeting. Voting instructions are provided on the Notice. You may also request to receive printed proxy materials in the mail. Stockholders who received printed proxy materials in the mail can vote by (i) filling out the proxy card and returning it in the postage paid return envelope, (ii) telephone (800-690-6903), (iii) Internet (www.proxyvote.com), or (iv) in person at the Annual Meeting. Voting instructions are provided on the proxy card.card or instruction card, as applicable. Stockholders who received proxy materials electronically can vote by (i) Internet (www.proxyvote.com), (ii) telephone (800-690-6903), or (iii) in person at the Annual Meeting. The cut off for voting by Internet or telephone is 11:59 p.m. (Eastern) on the day before the Annual Meeting. If you are a beneficial owner of our shares, you must vote by giving instructions to your bank, broker or other nominee or you may vote electronically during the Annual Meeting. You should follow the voting instructions on the form that you receive from your bank, broker or other nominee, which will include details on available voting methods. To be able to vote in person at the Annual Meeting, you must obtain a legal proxy from your bank, broker or other nominee in advance and present it to the Inspector of Election with your completed ballot at the Annual Meeting. Whether or not you plan to attend in the Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described above and in the proxy materials distributed to you in connection with the Annual Meeting. How will my proxy be voted? Your proxy card, when properly signed and returned to us, or processed by telephone or via the Internet, and not revoked, will be voted in accordance with your instructions. If any matter is properly presented other than the four proposals described above, the persons named in the enclosed proxy card or, if applicable, their substitutes, will have discretion to vote your shares in their best judgment. What if I don’t mark the boxes on my proxy or voting instruction card? Unless you give other instructions on your proxy card or your voting instruction card, or unless you give other instructions when you cast your vote by telephone or the Internet, the persons named in the enclosed proxy card will vote your shares in accordance with the recommendations of the Board, which are FOR the election of each director named in Proposal 1, and FOR Proposals 2 and 3 and 4.ONE YEAR for the advisory vote on the frequency of voting on named executive officer compensation (Proposal 4).

FORTUNE BRANDS INNOVATIONS•2024 PROXY STATEMENT

| FREQUENTLY ASKED QUESTIONS (CONTINUED)

Frequently Asked Questions | 66 |

If you are a beneficial owner and you have not provided voting instructions, your bank, broker or other nominee is only permitted to use its discretion to vote your shares on certain routine matters (only Proposal 2 qualifies as a routine matter for this purpose). If you have not provided voting instructions to your bank, broker or other nominee on non-routine matters (Proposals 1, 3 and 4), your bank, broker or other nominee is not permitted to use its discretion to vote your shares. Therefore, we urge you to give voting instructions to your bank, brokeror other nominee on all four proposals. Shares that are not permitted to be voted by your bank, broker or other nominee with respect to any matter are called “broker non-votes.” Broker non-votes are not considered votes for or against a proposal and will have no direct impact on the voting results, but will be counted for the purposes of establishing a quorum at the Annual Meeting. How many votes are needed to approve a proposal? The nominees for director in non-contested elections must receive a majority of the votes cast at the Annual Meeting, in person or by proxy, to be elected. A proxy card marked to abstain on the election of a director and any broker non-votes will not be counted as a vote cast with respect to that director. Under the Company’s majority vote Bylaw provision relating to the election of directors, if the number of votes cast “for” a director nominee does not exceed the number of votes cast “against” the director nominee, then the director must tender his or her resignation from the Board promptly after the certification of the stockholder vote. The Board (excluding the nominee in question) will decide within 90 days of that certification, through a process managed by the NESG Committee, whether to accept the resignation. The Board’s explanation of its decision will be promptly disclosed in a filing with the SEC. The affirmative vote of shares representing a majority in voting power of the common stock,Common Stock, present in person or represented by proxy at the Annual Meeting and entitled to vote on such matter is necessary for the approval of Proposals 2 3 and 3. For Proposal 4, stockholders may vote in favor of holding the vote to approve the compensation paid to the Company's named executive officers every one year, every two years or every three years. Stockholders also have the option to abstain from voting on Proposal 4. The option that receives the highest number of votes cast by stockholders will be considered by the Board as the stockholders' recommendation as to the frequency of future advisory votes on executive compensation. Proxy cards marked to abstain on Proposals 2 3 and 43 will have the effect of a negative vote. Proxy cards marked to abstain on Proposal 4 will have no effect on the outcome. Broker non-votes are not applicable to Proposal 2 because your bank, broker or other nominee will be permitted to use discretion to vote your shares on this proposal. Broker non-votes will have no impact on Proposals 1, 3 and 4. How can I revoke my proxy or change my vote? You may revoke your proxy by giving written notice to the Secretary of the Company or by delivering a later dated proxy at any time before it is actually voted. If you voted on the Internet or by telephone, you may change your vote by voting again. Your last vote is the vote that will be counted. Attendance at the virtual Annual Meeting does not revoke your proxy unless you vote at the Annual Meeting. Will my vote be public? As a matter of policy, proxies, ballots and tabulations that identify individual stockholders are not publicly disclosed but are available to the independent Inspector of Election and certain employees of the Company.

FORTUNE BRANDS INNOVATIONS•2024 PROXY STATEMENT

| Frequently Asked Questions | 67 |

What constitutes a quorum? The presence at the Annual Meeting, in person or by proxy, of the holders of a majority in voting power of the issued and outstanding shares of common stockCommon Stock entitled to vote will constitute a quorum. Proxies received but marked as abstentions or without any voting instructions will be included in the calculation of the number of shares considered to be present at the Annual Meeting. | FREQUENTLY ASKED QUESTIONS (CONTINUED)

|

Who is soliciting my proxy? Our Board is soliciting thisyour proxy. The Company will bear the expense of soliciting proxies for this Annual Meeting, including mailing costs. To ensure that there is sufficient representation at the Annual Meeting, our employees may solicit proxies by telephone, facsimile or in person. In addition, we have retained Okapi Partners LLC to provide investor response services and assist the Company in the solicitation of proxies at a solicitation fee of $20,000, plus related reasonable out-of-pocket expenses. What if I am a participant in the Fortune Brands Home & SecurityInnovations Retirement Savings Plan or the Fortune Brands Home & SecurityInnovations Hourly Employee Retirement Savings Plan? Participants who invest in the Fortune Brands Stock Fund through the Fortune Brands Home & SecurityInnovations Retirement Savings Plan andor the Fortune Brands Home & SecurityInnovations Hourly Employee Retirement Savings Plan (collectively, the “Savings Plans”) were mailed a Notice. The Trustee of the Savings Plans, as record holder of the Fortune Brands common stockCommon Stock held in the Savings Plans, will vote whole shares attributable to your interest in the Fortune Brands Stock Fund in accordance with your directions. Follow the voting instructions provided in the Notice to allow the Trustee to vote the whole shares attributable to your interest in accordance with your instructions. If the Trustee does not receive timely voting instructions with respect to the voting of your shares held in the Fortune Brands Stock Fund, the Trustee will vote such shares in the same manner and in the same proportion as the shares for which the Trustee did receive voting instructions. The Trustee must receive your voting instructions by 11:59 p.m. (Eastern) on May 2, 2024 in order to timely vote your interests in accordance with your directions. How can I eliminate multiple mailings to the same address? If you and other residents at your mailing address are registered stockholders and you receive more than one copy of the Notice, but you wish to eliminate the duplicate mailings, you must submit a written request to the Company’s transfer agent, EQ Shareowner Services. To request the elimination of duplicate copies, please write to EQ Shareowner Services, 1110 Centre Pointe Curve, Suite 101, Mendota Heights, Minnesota 55120. If you and other residents at your mailing address own shares in street name, your broker, bank or other nominee may have sent you a notice that your household will receive only one Notice or one set of proxy materials for each company in which you hold stock through that broker, bank or other nominee. This practice, known as “householding,” is designed to reduce our printing and postage costs. If you did not respond, the bank, broker or other nominee will assume that you have consented and will send only one copy of the Notice to your address. You may revoke your consent to householding at any time by sending your name, the name of your brokerage firm, and your account number to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. The revocation of your consent to householding will be effective 30 days following its receipt. In any event, if you did not receive an individual copy of the Notice or proxy materials, or if you wish to receive individual copies of such documents for future meetings, we will send an individual copy to you if you call Shareholder Services at (847) 484-4538, or write to the Secretary of Fortune Brands Innovations, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015.

FORTUNE BRANDS INNOVATIONS•2024 PROXY STATEMENT

| Frequently Asked Questions | 68 |

How can I submit a stockholder proposal or nomination next year? Our Bylaws provide that in order for a stockholder to (i) nominate a candidate for election to our Board at the 20232025 Annual Meeting of Stockholders, other than pursuant to our proxy access bylaw (discussed below), or (ii) propose business for consideration at the 20232025 Annual Meeting of Stockholders, written notice containing the information required by the Bylaws must be delivered to the Secretary of the Company no less than 90 days nor more than 120 days before the anniversary of the prior year’s Annual Meeting, that is, after January 3, 20237, 2025 but no later than February 2, 20236, 2025 for the 20232025 Annual Meeting. To nominate a director candidate to be included in our proxy materials for the 20232025 Annual Meeting of Stockholders pursuant to our proxy access bylaw, written notice containing the information required by the Bylaws must be delivered to the Secretary of the Company no less than 120 days nor more than 150 days before the anniversary of the date the definitive proxy statement was first made available to stockholders in connection with the prior year’s Annual Meeting, that is, after October 22, 202223, 2024 but no later than November 21, 202222, 2024 for the 20232025 Annual Meeting. | FREQUENTLY ASKED QUESTIONS (CONTINUED)

|

In addition to satisfying the foregoing requirements under the Bylaws, to comply with the universal proxy rules, (once effective), stockholders who intend to solicit proxies in support of director nominees other than management’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 4, 2023.8, 2025. Under SEC rules, if a stockholder wishes to submit a proposal for possible inclusion in the Company’s 20232025 proxy statement pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), we must receive it on or before November 21, 2022.22, 2024. The person presiding at the Annual Meeting is authorized to determine if a proposed matter is properly brought before the Annual Meeting or if a nomination is properly made. Copies of our Restated Certificate of Incorporation and Bylaws are available upon written request to the Secretary, Fortune Brands Home & Security,Innovations, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015.

FORTUNE BRANDS INNOVATIONS•2024 PROXY STATEMENT

| Appendix APPENDIX A | A-1 |

RECONCILIATIONSAppendix A

Operating Income Before Charges/Gains To Gaap Operating Income

(Unaudited)

(In millions)

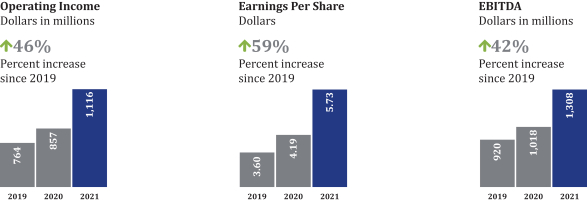

| | | | | | | | | | | | | | | | | | | | Twelve Months Ended December 31, | | | | | 2021 | | | 2020 | | | 2019 | | | % Change 2021 vs 2019 | | | | | | | | | | | | | | | | | | | Operating income before charges/gains | | $ | 1,116.3 | | | $ | 857.1 | | | $ | 764.0 | | | | 46 | | Restructuring charges(a) | | | (13.5 | ) | | | (15.9 | ) | | | (14.7 | ) | | | (8 | ) | Other charges(a) | | | | | | | | | | | | | | | | | Cost of product sold | | | (9.1 | ) | | | (10.4 | ) | | | (5.9 | ) | | | 54 | | Selling, general and administrative expenses | | | (3.3 | ) | | | (6.9 | ) | | | (3.4 | ) | | | (3 | ) | Asset impairment charges(b) | | | — | | | | (22.5 | ) | | | (41.5 | ) | | | (100 | ) | | | | | | | | | | | | | | | | | | Operating income (GAAP) | | $ | 1,090.4 | | | $ | 801.4 | | | $ | 698.5 | | | | 56 | | | | | | | | | | | | | | | | | | |

Operating income before charges/gains is operating income derived in accordance with U.S. generally accepted accounting principles (“GAAP”) excluding restructuring and other charges and asset impairment charges. Operating income before charges/gains is a measure not derived in accordance with GAAP. Management uses this measure to evaluate the returns generated by the Company and its business segments. Management believes this measure provides investors with helpful supplemental information regarding the underlying performance of the Company from period to period. This measure may be inconsistent with similar measures presented by other companies.

(a) (b) For definitions of Non-GAAP measures, see Definitions of Terms shown below.

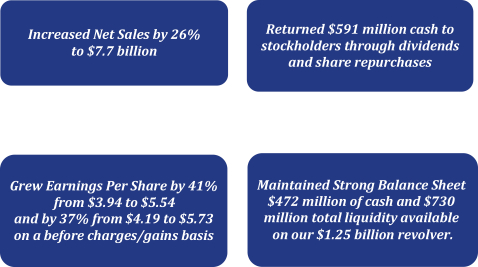

DILUTED EPS BEFORE CHARGES/GAINS RECONCILIATION

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | Twelve Months Ended December 31, | | | | | 2021 | | | 2020 | | | % Change

2021

vs 2020 | | | 2019 | | | % Change

2021

vs 2019 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Earnings Per Common Share - Diluted | | | | | | | | | | | | | | | | | | | | | Diluted EPS before charges/gains(c) | | $ | 5.73 | | | $ | 4.19 | | | | 37 | | | $ | 3.60 | | | | 59 | | | | | | | | Restructuring and other charges(a) | | | (0.17 | ) | | | (0.19 | ) | | | (11 | ) | | | (0.13 | ) | | | 31 | | Asset impairment charges(b) | | | — | | | | (0.13 | ) | | | (100 | ) | | | (0.22 | ) | | | (100 | ) | Tax items | | | — | | | | 0.03 | | | | (100 | ) | | | (0.01 | ) | | | (100 | ) | (Loss) gain on equity investments(e) | | | (0.02 | ) | | | 0.06 | | | | (133 | ) | | | — | | | | — | | Defined benefit plan actuarial losses(d) | | | — | | | | (0.02 | ) | | | (100 | ) | | | (0.18 | ) | | | (100 | ) | | | | | | | | | | | | | | | | | | | | | | Diluted EPS (GAAP) | | $ | 5.54 | | | $ | 3.94 | | | | 41 | | | $ | 3.06 | | | | 81 | | | | | | | | | | | | | | | | | | | | | | |

For the twelve months ended December 31, 2021, diluted EPS before charges/gains is net income less noncontrolling interests calculated on a diluted per-share basis excluding $28.1 million ($22.9 million after tax or $0.17 per diluted share) of restructuring and other charges, including $2.2 million of mark-to-market expense classified in the other expense, net associated with the acquisition of the remaining outstanding shares of Flo, which occurred in January 2022, loss on equity investments of $4.5 million ($3.4 million net of tax or $0.02 per diluted share), the impact from actuarial losses associated with our defined benefit plans of $1.0 million ($0.7 million net of tax) and a net tax expense of $0.2 million.

For the twelve months ended December 31, 2020, diluted EPS before charges/gains is net income less noncontrolling interests calculated on a diluted per-share basis excluding $33.2 million ($27.1 million after tax or

$0.19 per diluted share) of restructuring and other charges, asset impairment charges of $22.5 million ($17.6 million after tax or $0.13 per diluted share), gain on equity investments of $11.0 million ($8.3 million net of tax or $0.06 per diluted share), the impact from actuarial losses associated with our defined benefit plans of $3.2 million ($2.3 million after tax or $0.02 per diluted share) and a tax benefit of $3.8 million ($0.03 per diluted share).

For the twelve months ended December 31, 2019, diluted EPS before charges/gains is net income less noncontrolling interests calculated on a diluted per-share basis excluding $24.0 million ($18.1 million after tax or $0.13 per diluted share) of restructuring and other charges, intangible asset impairment charges of $41.5 million ($31.4 million after tax or $0.22 per diluted share), the impact from actuarial losses associated with our defined benefit plans of $34.1 million ($25.8 million after tax or $0.18 per diluted share) and a net tax charge of $1.3 million ($0.01 per diluted share).

(a) (b) (c) (d) (e) For definitions of Non-GAAP measures, see Definitions of Terms shown below.

EBITDA BEFORE CHARGES/GAINS TO NET INCOME

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | Twelve Months Ended December 31, | | | | | 2021 | | | 2020 | | | 2019 | | | % Change 2021 vs

2019 | | | | | | | | | | | | | | | | | | | | | | | | EBITDA BEFORE CHARGES/GAINS(f) | | $ | 1,308.2 | | | $ | 1,017.6 | | | $ | 919.9 | | | | 42 | | Depreciation* | | ($ | 121.1 | ) | | ($ | 113.0 | ) | | ($ | 109.4 | ) | | | 11 | | Amortization of intangible assets | | | (64.1 | ) | | | (42.0 | ) | | | (41.4 | ) | | | 55 | | Interest expense | | | (84.4 | ) | | | (83.9 | ) | | | (94.2 | ) | | | (10 | ) | Restructuring and other charges(a) | | | (28.1 | ) | | | (33.2 | ) | | | (24.0 | ) | | | 17 | | Asset impairment charges(b) | | | — | | | | (22.5 | ) | | | (41.5 | ) | | | (100 | ) | Equity in losses of affiliate | | | — | | | | (7.6 | ) | | | — | | | | — | | (Loss) gain on equity investments(e) | | | (4.5 | ) | | | 11.0 | | | | — | | | | (100 | ) | Defined benefit plan actuarial losses(d) | | | (0.9 | ) | | | (3.2 | ) | | | (34.1 | ) | | | (97 | ) | Income taxes | | | (232.7 | ) | | | (168.8 | ) | | | (144.0 | ) | | | 62 | | | | | | | | | | | | | | | | | | | Net income (GAAP) | | $ | 772.4 | | | $ | 554.4 | | | $ | 431.3 | | | | 79 | | | | | | | | | | | | | | | | | | |

* Depreciation excludes accelerated depreciation expense for the twelve months ended December 31, 2021 of ($3.9) million, 2020 of ($8.5) million and 2019 of ($1.9) million. Accelerated depreciation is included in restructuring and other charges.

(a) (b) (d) (e) (f) For definitions of Non-GAAP measures, see Definitions of Terms shown below.

Definitions of Terms: Non-GAAP Measures

(a) Restructuring charges are costs incurred to implement significant cost reduction initiatives and include workforce reduction costs. “Other charges” represent pre-tax charges or gains directly related to restructuring initiatives that cannot be reported as restructuring under GAAP. Such costs may include losses on disposal of inventories, trade receivables allowances from exiting product lines, accelerated depreciation resulting from the closure of facilities, write-off of displays from exiting a customer relationship, impairments related to previously closed facilities and gains or losses on the sale of previously closed facilities.

In total, the Company recognized other charges of $7.2 million for the twelve months ended December 31, 2021, $9.2 million for the twelve months ended December 31, 2020 and $7.5 million for the twelve months ended December 31, 2019.

At Corporate, other charges for the twelve months ended December 31, 2021 include $0.3 million for banking, legal, accounting and other similar services directly related to the acquisition of LARSON classified in selling, general and administrative expenses, a charge of $0.2 million for a loss on sale of a Corporate asset and $1.3 million of external costs directly related to evaluation of acquisition targets. These external costs include expenditures for accounting, tax and other similar services. Restructuring and other charges for the twelve months ended December 31, 2021 include a mark-to-market expense of $2.2 million classified in the other expense, net associated with the acquisition of the remaining outstanding shares of Flo, which occurred in January 2022. Other charges for the twelve months ended December 31, 2020 include expenditures of $4.5 million for banking, legal, accounting and other similar services directly related to the acquisition of LARSON classified in selling, general and administrative expenses and a charge of $3.6 million for an impairment of a Corporate asset.

In our Outdoors & Security segment, other charges for the twelve months ended December 31, 2021 include an acquisition-related inventory step-up expense (LARSON) of $3.4 million classified in cost of products sold. Other charges also include an acquisition-related inventory step-up expense (Fiberon) classified in cost of products sold of $1.8 million for the twelve months ended December 31, 2019.

(b) Asset impairments charges for the twelve months ended December 31, 2020 represent impairment charges of $22.5 million related to indefinite-lived tradenames in our Cabinets and Plumbing segments. Asset impairments charges for the twelve months ended December 31, 2019 represent impairment charge of $41.5 million related to indefinite-lived tradenames in our Cabinets segment.

(c) Diluted EPS before charges/gains is net income less noncontrolling interests calculated on a diluted per-share basis excluding restructuring and other charges, asset impairment charges, tax items, gain (loss) on equity investments and losses associated with our defined benefit plans. Diluted EPS before charges/gains is a measure not derived in accordance with GAAP. Management uses this measure to evaluate the overall performance of the Company and believes this measure provides investors with helpful supplemental information regarding the underlying performance of the Company from period to period. This measure may be inconsistent with similar measures presented by other companies.

(d) Represents actuarial gains or losses associated with our defined benefit plans. Actuarial gains or losses in a period represent the difference between actual and actuarially assumed experience, principally related to liability discount rates and plan asset returns, as well as other actuarial assumptions including compensation rates, turnover rates, and health care cost trend rates. The Company recognizes actuarial gains or losses immediately in other income (expense) to the extent they cumulatively exceed a “corridor.” The corridor is equal to the greater of 10% of the fair value of plan assets or 10% of a plan’s projected benefit obligation. Actuarial gains or losses are determined at required remeasurement dates which occur at least annually in the fourth quarter. Remeasurements due to plan amendments and settlements may also occur in interim periods during the year. Our other income (expense) reflects our expected rate of return on pension plan assets which in a given period may materially differ from our actual return on plan assets. Our liability discount rates and plan asset returns are based upon difficult to predict fluctuations in global bond and equity markets that are not directly related to the Company’s business. We believe that the exclusion of actuarial gains or losses from diluted EPS before charges/gains provides investors with useful supplemental information regarding the underlying performance of the business from period to period that may be considered in conjunction with our diluted EPS as measured on a GAAP basis. We present this supplemental information because such actuarial gains or losses may create volatility in our diluted EPS that does not necessarily have an immediate corresponding impact on operating cash flow or the actual compensation and

benefits provided to our employees. The table below sets forth additional supplemental information on the Company’s historical actual and expected rate of return on plan assets, as well as discount rates used to value its defined benefit obligations:

| | | | | | | | | | | | | | | | | | | | | | | | | ($ In millions) | | Year Ended

December 31,

2021 | | | Year Ended

December 31,

2020 | | | Year Ended

December 31,

2019 | | | | | % | | | $ | | | % | | | $ | | | % | | | $ | | Actual return on plan assets | | | 6.6 | % | | $ | 48.4 | | | | 16.5 | % | | $ | 101.3 | | | | 19.7 | % | | $ | 106.8 | | Expected return on plan assets | | | 4.4 | % | | | 34.9 | | | | 4.5 | % | | | 32.8 | | | | 4.9 | % | | | 35.2 | | Discount rate at December 31: | | | | | | | | | | | | | | | | | | | | | | | | | Pension benefits | | | 2.9 | % | | | | | | | 2.6 | % | | | | | | | 3.3 | % | | | | | Postretirement benefits | | | 3.9 | % | | | | | | | 5.9 | % | | | | | | | 3.0 | % | | | | |

(e) Gain (loss) on equity investments is related to our investment in Flo Technologies.

(f) EBITDA before charges/gains is net income derived in accordance with GAAP excluding depreciation, amortization of intangible assets, interest expense, restructuring and other charges, asset impairment charges, equity in losses of affiliate, gain (loss) on equity investments, losses associated with our defined benefit plans and income taxes. EBITDA before charges/gains is a measure not derived in accordance with GAAP. Management uses this measure to assess returns generated by the Company. Management believes this measure provides investors with helpful supplemental information about the Company’s ability to fund internal growth, make acquisitions and repay debt and related interest. This measure may be inconsistent with similar measures presented by other companies.

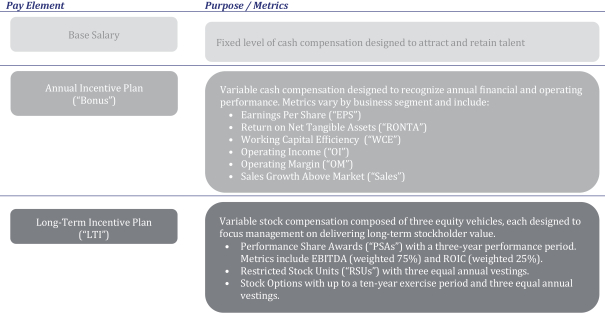

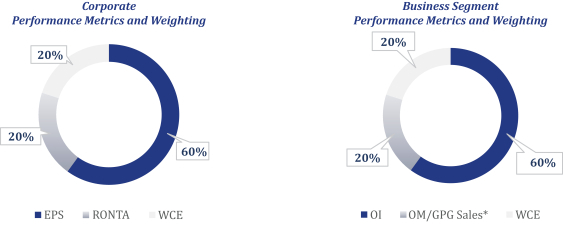

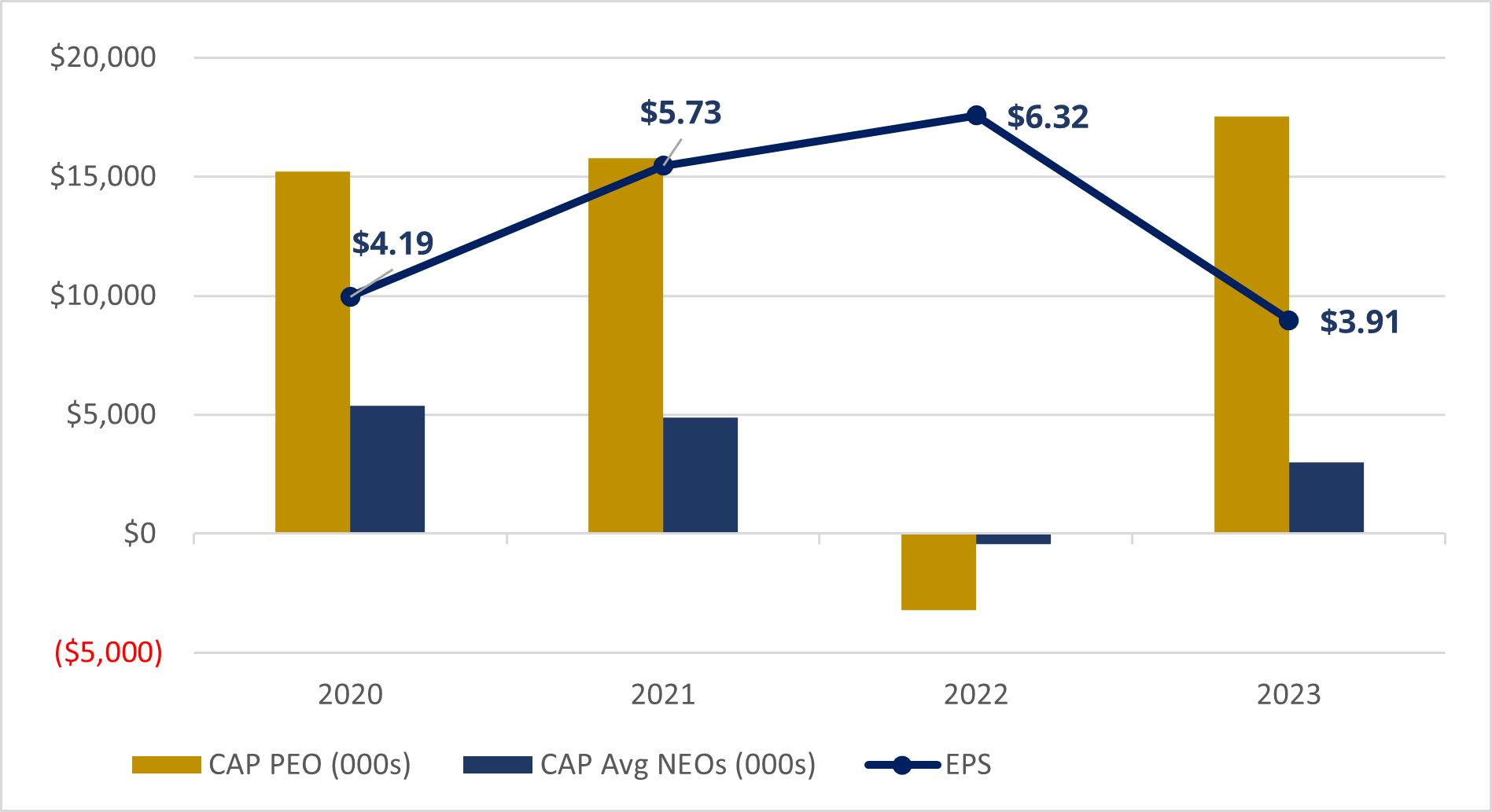

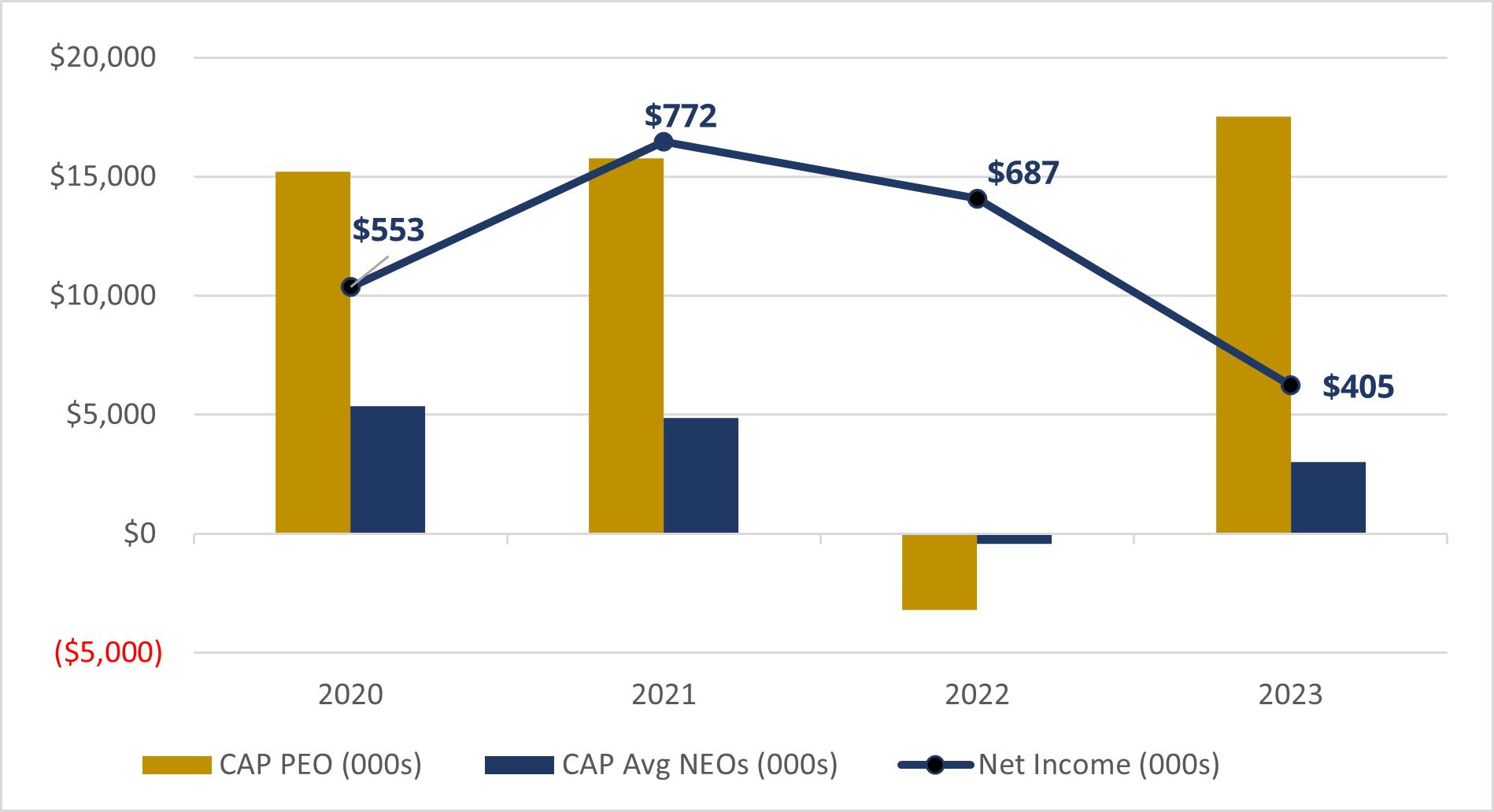

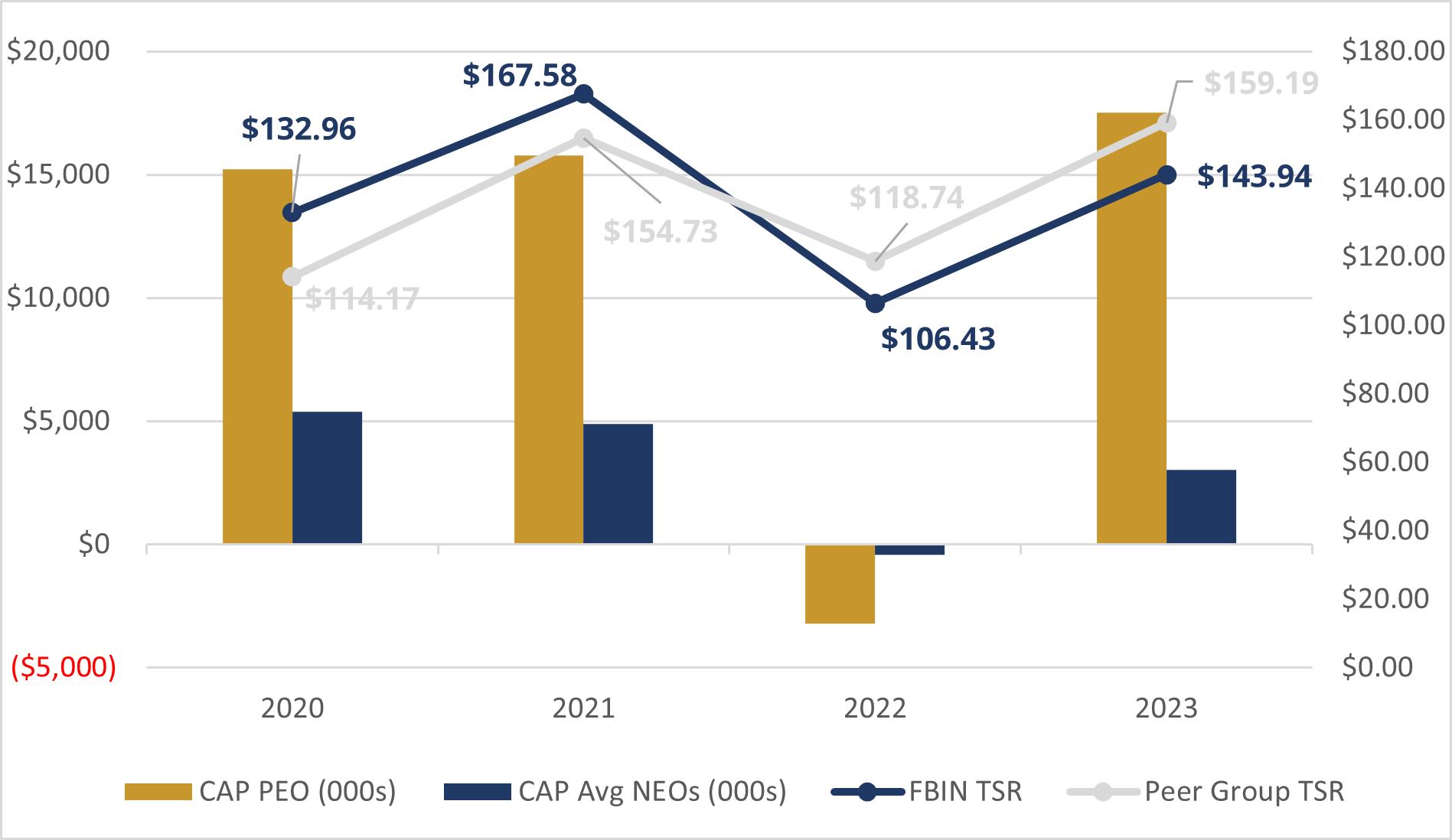

Use of Non-GAAP Financial Information in Connection with Incentive Compensation The Company utilizes measures not derived in accordance with GAAP, such as Operating Margin (OM) before charges/ gains, Operating Income (OI) before charges/gains, Earnings Per Share (EPS) before charges/gains, Return on Net Tangible Assets (RONTA)Operating Income Margin Percent (OIMP) before charges/gains, Return on Invested Capital (ROIC) before charges/gains, Sales Growth Above Market (Sales), Working Capital Efficiency (WCE) and, Earnings Before Interest, Taxes, Depreciation and Amortization Margin Percent (EBITDA) before charges/gains and Return on Invested Capital before charges/gain, when determining performance results in connection with the incentive compensation programs as described in the Compensation Discussion and Analysis (“CD&A”). For purposes of calculating the 20212023 Annual Incentive Award payout, EPS, RONTA, OIOIMP and OMWCE results as set forth in the CD&A were calculated on a before charges/gains basis. EPS results were adjusted for the impact of actual foreign exchange rates versus plan foreign exchange rates. RONTA results (cumulative 12-month OI) were adjusted to exclude any restructuring and other charges and asset impairment charges,OIMP is Operating Income divided by a thirteen-point rolling average of Net Tangible Assets (Total assets less Intangible assets and Total Current Liabilities). Operating Income and Operating Margin results as set forth in the CD&A were adjusted for the impact of actual foreign exchange rates versus plan foreign exchange rates.Sales. WCE is the 13-month rolling average of Net Working Capital (Accounts Receivable and Inventory less Accounts Payable) divided by 12-month cumulative Net Sales. GPG Sales Growth Above Market was determined by calculating the percentage change in GPG’s annual sales in excess of the percentage change in the Plumbing market’s prior year sales. For purposes of calculating the 2019-2021 Performance Share Award payout, EBITDA and ROIC results as set forth in the CD&A were calculated on a before charges/gains basis. The 2019-2021 EBITDA results exclude restructuring and other charges and other select items, including depreciation, asset impairment charges, equity in losses of affiliate, (loss) gain on equity investments, losses associated with our defined benefit plans, amortization of intangible assets, interest expense and income taxes. The 2019-2021 ROIC results represent net income, less noncontrolling interest adjusted for after tax interest expense and exclude restructuring and other charges, asset

impairment charges, and other select items, divided by a two point average of GAAP Invested Capital (Net Debt plus Stockholders’ Equity), excluding any restructuring and other charges and other select items.

These figures may be different from those used by management when providing guidance or discussing Company results. These measures should not be considered in isolation or as a substitute for any measure derived in accordance with GAAP and may also be inconsistent with similar measures presented by other companies.

The financial resultsFORTUNE BRANDS INNOVATIONS•2024 PROXY STATEMENT

SCAN TO VIEW MATERIALS & VOTE FORTUNE BRANDS INNOVATIONS, INC. ATTN: CORPORATE SECRETARY p520 LAKE COOK ROAD DEERFIELD, IL 60015-5611 VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of LARSON were includedinformation up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the Company’s consolidated balance sheet as of December 31, 2020. Net sales, operating income and cash flows for LARSON from the date of acquisitionpostage-paid envelope we have provided or return it to December 31, 2020 were not material to the Company. FORTUNE BRANDS HOME & SECURITY, INC.

2022 LONG-TERM INCENTIVE PLAN

I INTRODUCTION

1.1 Purposes. The purposes of the Fortune Brands Home & Security, Inc. 2022 Long-Term Incentive Plan (this “Plan”) are (i) to align the interests of the Company’s stockholders and the recipients of awards under this Plan by increasing the proprietary interest of such recipients in the Company’s growth and success, (ii) to advance the interests of the Company by attracting and retaining directors, officers, other employees and independent contractors, and (iii) to motivate such persons to act in the long-term best interests of the Company and its stockholders.

“Agreement” means the agreement between the Company and the recipient of an award setting forth the terms and conditions of the award (which may be in written or electronic form).

“Board” means the board of directors of the Company.

“Change in Control” has the meaning set forth in Section 5.8(b).

“Code” means the Internal Revenue Code of 1986, as amended.

“Committee” means the committee designated by the Board, consisting of two or more members of the Board, each of whom is intended to be (i) a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act and (ii) “independent” within the meaning of the rules of New York Stock Exchange or any other stock exchange on which the Common Stock is then traded. The “Committee” means the Nominating, Environmental, Social and Corporate Governance Committee (or a subcommittee thereof) of the Board with respect to awards granted to non-employee directors and the Compensation Committee of the Board (or a subcommittee thereof) with respect to awards granted to all other recipients; provided, however, that the Board may, in its discretion, serve as the Committee under the Plan.

“Common Stock” means the common stock, par value $0.01 per share, of the Company, and all appurtenant rights.

“Company” means Fortune Brands Home & Security, Inc., a Delaware corporation, or any successor.

“Continuing Directors” has the meaning set forth in Section 5.8(b)(ii).

“Effective Date” has the meaning set forth in Section 5.1.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Fair Market Value” means a price that is based on the opening, closing, actual, high, low, or average selling prices of a share of Common Stock reported on the New York Stock Exchange or such other established stock exchange on which the shares are principally traded on the applicable date, the preceding trading day, the next succeeding trading day, or an average of trading days, as determined by the Committee in its discretion. Unless the Committee determines otherwise, Fair Market Value shall be deemed to be equal to the reported closing sales price of a share of Common Stock on the date as of which such value is being determined or, if there shall be no reported transactions for such date, on the preceding date for which transactions were reported; provided, however, that if the shares of Common Stock are not publicly traded at the time a determination of their value is required to be made hereunder, the determination of their Fair Market Value shall be made by the Committee in such manner as it deems appropriate and in accordance with Section 409A of the Code.

“Incentive Stock Option” means an option to purchase shares of Common Stock that meets the requirements of Section 422 of the Code, or any successor provision, which is intended by the Committee to constitute an Incentive Stock Option.

“Newco” has the meaning set forth in Section 5.8(b)(iii).

“Nonqualified Stock Option” means an option to purchase shares of Common Stock which is not an Incentive Stock Option.

“Other Stock-Based Award” means an award granted pursuant to Section 3.4.

“Option” means an Incentive Stock Option or a Nonqualified Stock Option.

“Performance Award” means an award of Performance Shares or Performance Units.

“Performance Measures” means the criteria and objectives, established by the Committee, which shall be satisfied or met (i) as a condition to the grant or exercisability of all or a portion of an option or SAR or (ii) during the applicable Restriction Period or Performance Period as a condition to the vesting of the holder’s interest, in the case of a Restricted Stock Award, of the shares of Common Stock subject to such award, or, in the case of a Restricted Stock Unit Award, Other Stock Award or Performance Award, to the holder’s receipt of the shares of Common Stock subject to such award or of payment with respect to such award. Such criteria and objectives may include one or more of the following corporate-wide or Subsidiary, division, joint venture, operating unit or individual measures: (i) net earnings; (ii) operating earnings or income; (iii) earnings growth; (iv) net income; (v) net income applicable to shares; (vi) gross revenue or revenue by pre-defined business segment; (vii) ratio of operating expenses to operating revenues; (viii) margins realized on delivered services; (ix) cash flow, including operating cash flow, free cash flow, discounted cash flow return on investment, and cash flow in excess of cost of capital; (x) earnings per share; (xi) return on stockholders’ equity; (xii) stock price; (xiii) return on common stockholders’ equity; (xiv) return on capital; (xv) return on assets; (xvi) economic value added (income in excess of cost of capital); (xvii) customer satisfaction; (xviii) cost control or expense reduction; (xix) operating company contribution; (xx) income before income taxes; (xxi) total return to stockholders, in each case, absolute or relative to peer-group comparative; (xxii) earnings before interest, depreciation and/or amortization and (xxiii) strategic business criteria, which may consist of one or more objectives based on meeting goals relating to market penetration, geographic business expansion, cost targets, customer satisfaction, reductions in errors and omissions, reductions in lost business, management of employment practices and employee benefits, supervision of litigation and information technology, quality and quality audit scores, acquisitions or divestitures, and such other goals as the Committee may determine whether or not listed herein, or any combination of the foregoing. Such Performance Measures may also be based upon the attainment by the Company, a Subsidiary division, joint venture or operating unit of specified levels of performance under one or more of the measures described above relative to the performance of other companies. The applicable Performance Measures may be applied on a pre- or post-tax basis and may be adjusted to include or exclude components of any performance measure, including, without limitation: extraordinary, unusual, infrequently occurring or non-recurring items; changes in law or accounting principles; currency fluctuations; financing activities (e.g., effect on earnings per share of issuance of convertible debt securities); realized or unrealized gains and losses on securities; expenses, charges or credits for restructuring initiatives, productivity initiatives or for impaired assets; non-cash items (e.g., amortization, depreciation or reserves); other non-operating items; write downs of intangible assets, property, plant or equipment, investments in business units and securities resulting from the sale of business units; spending for acquisitions; and effects of any recapitalization, reorganization, merger, acquisition, divestiture, consolidation, spin-off, split-off, combination, liquidation, dissolution, sale of assets, or other similar items determined by the Committee (“Adjustment Events”). In the sole discretion of the Committee, the Committee may amend or adjust the Performance Measures or other terms and conditions of an outstanding award in recognition of any Adjustment Events. Performance goals shall be subject to such other special rules and conditions as the Committee may establish.

“Performance Period” means any period designated by the Committee during which the Performance Measures applicable to an award shall be measured.

“Performance Share” means a right to receive, contingent upon the attainment of specified Performance Measures within a specified Performance Period, a specified number of shares of Common Stock (which may be shares of Restricted Stock).

“Performance Unit” means a right to receive, contingent upon the attainment of specified Performance Measures within a specified Performance Period, a specified cash amount.

“Prior Plan” means the Fortune Brands Home & Security, Inc. 2013 Long-Term Incentive Plan and Fortune Brands Home & Security, Inc. 2011 Long-Term Incentive Plan.

“Restricted Stock” means shares of Common Stock which are subject to a Restriction Period and which may also be subject to the attainment of specified Performance Measures within a specified Performance Period.

“Restricted Stock Award” means an award of Restricted Stock under this Plan.

“Restricted Stock Unit” means a right to receive one share of Common Stock or, to the extent set forth in the applicable award Agreement, the Fair Market Value of a share of Common Stock in cash, which is contingent upon the expiration of a specified Restriction Period and which may also be contingent upon the attainment of specified Performance Measures within a specified Performance Period.

“Restricted Stock Unit Award” means an award of Restricted Stock Units under this Plan.

“Restriction Period” means any period designated by the Committee during which (i) shares of Common Stock subject to a Restricted Stock Award or Other Stock-Based Award may not be sold, transferred, assigned, pledged, hypothecated or otherwise encumbered or disposed of, except as provided in this Plan or the Agreement relating to such award, or (ii) the conditions to vesting applicable to a Restricted Stock Unit Award or Other Stock-Based Award shall remain in effect.

“SAR” means a stock appreciation right which entitles the holder to receive, upon exercise, shares of Common Stock (which may be Restricted Stock) with an aggregate value equal to the excess of the Fair Market Value of one share of Common Stock on the date of exercise over the base price of such SAR or, to the extent permitted by an Agreement, cash equal to the excess of the Fair Market Value of one share of Common Stock on the date of exercise over the base price of such SAR or a combination of both.

“Stock Award” means a Restricted Stock Award, a Restricted Stock Unit Award or an Other Stock-Based Award.

“Subsidiary” means any corporation, limited liability company, partnership, joint venture or similar entity in which the Company owns, directly or indirectly, an equity interest possessing more than 20% of the combined voting power of the total outstanding equity interests of such entity, except that with respect to Incentive Stock Options, “Subsidiary” means “subsidiary corporation” as defined in Section 424(f) of the Code.

“Substitute Award”means an award granted under this Plan upon the assumption of, or in substitution for, outstanding equity awards previously granted by a company or other entity in connection with a corporate transaction, including a merger, combination, consolidation or acquisition of property or stock; provided, however, that in no event shall the term “Substitute Award” be construed to refer to an award made in connection with the cancellation and repricing of an Option or SAR.

“Tax Date” has the meaning set forth in Section 5.5.

“Ten Percent Holder” has the meaning set forth in Section 2.1(a).

“Voting Securities” has the meaning set forth in Section 5.8(b)(i).

1.3 Administration. This Plan shall be administered by the Committee. Any one or a combination of the following awards may be made under this Plan to eligible persons: (i) Incentive Stock Options or Nonqualified Stock Options, (ii) SARs, (iii) Stock Awards in the form of Restricted Stock, Restricted Stock Units or Other Stock-Based Awards and (iv) Performance Awards. The Committee shall, subject to the terms of this Plan, select eligible persons for participation in this Plan and determine the form, amount and timing of each award to such persons and, if applicable, the number of shares of Common Stock, the number of SARs, the number of Restricted Stock Units and the number of Performance Units subject to such an award, the exercise price or base price associated with the award, the time and conditions of exercise or settlement of the award and all other terms and conditions of the award, including, without limitation, the form of the Agreement evidencing the award. The Committee may, in its sole discretion and for any reason at any time, take action such that (i) any or all outstanding Options and SARs shall become exercisable in part or in full, (ii) all or a portion of the Restriction Period applicable to any outstanding Stock Award shall lapse, (iii) all or a portion of the Performance Period applicable to any outstanding award shall lapse and (iv) the Performance Measures (if any) applicable to any outstanding award shall be deemed to be satisfied at the target, maximum or any other interim level. The Committee shall, subject to the terms of this Plan, interpret this Plan, establish rules and regulations it deems necessary or desirable for the administration of this Plan and may impose, incidental to the grant of an award, conditions with respect to the award, such as limiting competitive employment or other activities. All such interpretations, rules, regulations and conditions shall be conclusive and binding on all parties.

The Committee may delegate some or all of its power and authority hereunder to the Board (or any members thereof) or, subject to applicable law, to a subcommittee of the Board, a member of the Board, the Chief Executive Officer or other executive officer of the Company as the Committee deems appropriate; provided, however, that the Committee may not delegate its power and authority to a member of the Board, the Chief Executive Officer or other executive officer of the Company with regard to the selection for participation in this Plan of an officer, director or other person subject to Section 16 of the Exchange Act or decisions concerning the timing, pricing or amount of an award to such an officer, director or other person.

No member of the Board or Committee, and neither the Chief Executive Officer nor any other executive officer to whom the Committee delegates any of its power and authority, shall be liable for any act, omission, interpretation, construction or determination made in connection with this Plan in good faith, and the members of the Board and the Committee and the Chief Executive Officer or other executive officer shall be entitled to indemnification and reimbursement by the Company for any claims, losses, damages or expenses (including attorneys’ fees) arising from any such act, omission, interpretation, construction or determination to the full extent permitted by law (except as otherwise may be provided in the Company’s Restated Certificate of Incorporation and/or Amended and Restated Bylaws) and under any directors’ and officers’ liability insurance that may be in effect from time to time.

1.4Eligibility.Participants in this Plan shall consist of such officers, other employees, non-employee directors, independent contractors and persons expected to become officers, other employees, non-employee directors, and independent contractors of the Company or any of its Subsidiaries, as the Committee in its sole discretion may select from time to time. The Committee’s selection of a person to participate in this Plan at any time shall not require the Committee to select such person to participate in this Plan at any other time. Except as otherwise provided in an Agreement, for purposes of this Plan, references to employment by the Company shall also mean employment by a Subsidiary, and references to employment shall include service as a non-employee director or independent contractor. Except as otherwise determined by the Committee, an employee who is granted a leave of absence in writing shall be deemed to be employed during such leave of absence. The aggregate value of cash compensation and the grant date fair value of shares of Common Stock that may be awarded or granted during any fiscal year of the Company to any Non-Employee Director, for his or her services as a Non-Employee Director, shall not exceed $1,000,000; provided, further, that this limit shall not apply to distributions of previously deferred compensation under a deferred compensation plan maintained by the Company or compensation received by the director in his or her capacity as an executive officer or employee of the Company.

1.5 Shares Available. Subject to adjustment as provided in Section 5.7 and to all other limits set forth in this Section 1.5, the total number of shares of Common Stock initially available under the Plan for the grant of new awards shall be the sum of (i) 3,300,000 and (ii) the number of shares of Common Stock that remain available for issuance under the Prior Plan as of the Effective Date, other than Substitute Awards. To the extent that the Company grants awards under the Plan, the number of shares of Common Stock that remain available for future grants under the Plan shall be reduced by one share for each share subject to such awards. To the extent that shares of Common Stock subject to an outstanding Option, SAR, Stock Award or Performance Award granted under this Plan or the Prior Plan, other than Substitute Awards, are not issued or delivered by reason of: (a) the expiration, termination, cancellation or forfeiture of such award; (b) the settlement of such award in cash;or (c) the use of shares to satisfy withholding taxes related to an award other than an Option or SAR, then such shares of Common Stock shall again be available under this Plan on a one-for-one basis. Notwithstanding anything in this Section 1.5 to the contrary, shares of Common Stock subject to an award under this Plan or the Prior Plan may not again be made available for issuance under this Plan if such shares are: (i) shares delivered to or withheld by the Company to pay the exercise price of an Option; (ii) shares used to satisfy the withholding taxes relating to an Option or SAR; (iii) shares that were subject to an Option or SAR and were not issued upon the net settlement of such award; or (iv) shares repurchased by the Company on the open market with the proceeds of an option exercise.

The number of shares of Common Stock available for awards under this Plan shall not be reduced by (i) the number of shares of Common Stock subject to Substitute Awards or (ii) available shares under a stockholder approved plan of a company or other entity which was a party to a corporate transaction with the Company (as appropriately adjusted to reflect such corporate transaction) which become subject to awards granted under this Plan (subject to applicable stock exchange requirements).

Shares of Common Stock to be delivered under this Plan shall be made available from authorized and unissued shares of Common Stock, or authorized and issued shares of Common Stock reacquired and held as treasury shares or otherwise or a combination of both.

II STOCK OPTIONS AND STOCK APPRECIATION RIGHTS

2.1 Stock Options. The Committee may, in its discretion, grant Options to such eligible persons as may be selected by the Committee; provided that Incentive Stock Options may be granted only to employees. Any portion of an Option that is not an Incentive Stock Option shall be a Nonqualified Stock Option. To the extent that the aggregate Fair Market Value (determined as of the date of grant) of shares of Common Stock with respect to which Options designated as Incentive Stock Options are exercisable for the first time by the holder during any calendar year (under this Plan or any other plan of the Company, or any parent or Subsidiary) exceeds the amount established by the Code (currently $100,000), such Options shall constitute Nonqualified Stock Options.

Options shall be subject to the following terms and conditions and shall contain such additional terms and conditions, not inconsistent with the terms and conditions of this Plan, as the Committee shall deem advisable:

(a) Number of Shares and Purchase Price. The number of shares of Common Stock subject to an Option and the purchase price per share of Common Stock purchasable upon exercise of the Option shall be determined by the Committee; provided, however, that the purchase price per share of Common Stock purchasable upon exercise of an Option shall not be less than 100% of the Fair Market Value of a share of Common Stock on the date of grant of such Option; and provided further, that if an Incentive Stock Option shall be granted to any person who, at the time such Option is granted, owns capital stock possessing more than ten (10) percent of the total combined voting power of all classes of capital stock of the Company (or of any parent or Subsidiary) (a “Ten Percent Holder”), the purchase price per share of Common Stock shall not be less than the price required by the Code (currently 110% of Fair Market Value) in order to constitute an Incentive Stock Option.

Notwithstanding the foregoing, in the case of an Option that is a Substitute Award, the purchase price per share of the shares subject to such Option may be less than 100% of the Fair Market Value per share on the date of grant, provided, that the excess of: (a) the aggregate Fair Market Value (as of the date such Substitute Award is granted) of the shares subject to the Substitute Award, over (b) the aggregate purchase price thereof does not exceed the excess of: (x) the aggregate fair market value (as of the time immediately preceding the transaction giving rise to the Substitute Award, such fair market value to be determined by the Committee) of the shares of the predecessor company or other entity that were subject to the grant assumed or substituted for by the Company, over (y) the aggregate purchase price of such shares.

(b) Option Period and Exercisability. The period during which an Option may be exercised shall be determined by the Committee; provided, however, that no Option (other than a Nonqualified Stock Option exercisable by an optionee’s executor, administrator, legal representative, guardian or similar person after the optionee’s death, to the extent permitted in the Agreement) shall be exercised later than ten (10) years after its date of grant; and provided further, that if an Incentive Stock Option shall be granted to a Ten Percent Holder, such Option shall not be exercised later than five (5) years after its date of grant. The Committee may, in its discretion, determine that an Option is to be granted as a performance-based Option and may establish an applicable Performance Period and Performance Measures which shall be satisfied or met as a condition to the grant of such Option or to the exercisability of all or a portion of such Option. The Committee shall determine whether an Option shall become exercisable in cumulative or non-cumulative installments and in part or in full at any time. An Option may be exercised only with respect to whole shares of Common Stock.

(c) Method of Exercise. An Option may be exercised (i) by specifying the number of whole shares of Common Stock to be purchased in the manner prescribed by the Company, accompanied by full payment (or by arranging for full payment to the Company’s satisfaction) either (A) in cash, (B) by delivery to the Company (either actual delivery or by attestation procedures established by the Company) of shares of Common Stock having an aggregate Fair Market Value, determined as of the date of exercise, equal to the aggregate purchase price payable pursuant to the Option, (C) authorizing the Company to sell shares of Common Stock subject to the option exercise and withhold from the proceeds an amount equal to the option exercise price, (D) authorizing the Company to withhold whole shares of Common Stock which would otherwise be delivered having an aggregate Fair Market Value, determined as of the date of exercise, equal to the amount necessary to satisfy such obligation, (E) in cash by a broker-dealer acceptable to the Company to whom the participant has submitted an irrevocable notice of exercise, (F) by a combination of (A), (B), (C) and (D), or (G) by any other method established by the Committee and set forth in an Agreement; and (ii) by executing such documents as the Company may reasonably request. Any fraction of a share of Common Stock which would be required to pay such purchase price shall be disregarded, and the remaining amount due shall be paid in cash by the optionee. No shares of Common Stock shall be issued or delivered until the full purchase price and any related withholding taxes, as described in Section 5.5, have been paid (or arrangement made for such payment to the Company’s satisfaction).

2.2 Stock Appreciation Rights. The Committee may, in its discretion, grant SARs to such eligible persons as may be selected by the Committee. SARs shall be subject to the following terms and conditions and shall contain such additional terms and conditions, not inconsistent with the terms and conditions of this Plan, as the Committee shall deem advisable:

(a) Number of SARs and Base Price. The number of SARs subject to an award shall be determined by the Committee. The base price of an SAR shall be determined by the Committee; provided, however, that such base price shall not be less than 100% of the Fair Market Value of a share of Common Stock on the date of grant of such SAR. The Agreement relating to an SAR shall specify whether the SAR may be settled in shares of Common Stock (including Restricted Stock), cash or a combination of both shares and cash.

Notwithstanding the foregoing, in the case of an SAR that is a Substitute Award, the base price per share of the shares subject to such SAR may be less than 100% of the Fair Market Value per share on the date of grant, provided, that the excess of: (a) the aggregate Fair Market Value (as of the date such Substitute Award is granted) of the shares subject to the Substitute Award, over (b) the aggregate base price thereof does not exceed the excess of: (x) the aggregate fair market value (as of the time immediately preceding the transaction giving rise to the Substitute Award, such fair market value to be determined by the Committee) of the shares of the predecessor company or other entity that were subject to the grant assumed or substituted for by the Company, over (y) the aggregate base price of such shares.

(b) Exercise Period and Exercisability.The period for the exercise of an SAR shall be determined by the Committee; provided, however, that no SAR (other than an SAR exercisable by a holder’s executor, administrator, legal representative, guardian or similar person after the holder’s death, to the extent permitted in the Agreement) shall be exercised later than ten (10) years after its date of grant. The Committee may, in its discretion, establish Performance Measures which shall be satisfied or met as a condition to the grant of an SAR or to the exercisability of all or a portion of an SAR. The Committee shall determine whether an SAR may be exercised in cumulative or non-cumulative installments and in part or in full at any time. SARs may be exercised only with respect to a whole number of SARs. If an SAR is exercised for shares of Restricted Stock, such shares shall be transferred to the holder in book entry form with restrictions on the Shares duly noted, and the holder of such Restricted Stock shall have the same rights of a stockholder of the Company as a holder of a Restricted Stock Award would have pursuant to Section 3.2(d). Prior to the exercise of an SAR, the holder of such SAR shall have no rights as a stockholder of the Company with respect to the shares of Common Stock subject to such SAR.

(d) Method of Exercise.SARs may be exercised (i) by specifying the whole number of SARs which are being exercised in the manner prescribed by the Company and (ii) by executing such documents as the Company may reasonably request.No shares of Common Stock shall be issued and no certificate representing Common Stock or cash payment shall be delivered until any withholding taxes thereon, as described in Section 5.5, have been paid (or arrangement made for such payment to the Company’s satisfaction).

2.3 Termination of Employment or Service. All of the terms relating to the exercise, cancellation or other disposition of an Option or SAR upon a termination of employment or service with the Company of the holder of such Option or SAR, as the case may be, whether by reason of disability, retirement, death or any other reason, shall be determined by the Committee and set forth in the applicable award Agreement.

2.4 No Repricing. The Committee shall not, without the approval of stockholders of the Company, (a) reduce the purchase price or base price of any outstanding Option or SAR, (b) cancel any outstanding Option or SAR in exchange for another Option or SAR with a lower purchase price or base price, (c) cancel any outstanding Option or SAR in exchange for cash or another award if the purchase price of the Option or the base price of the SAR exceeds the Fair Market Value of a share of Common Stock on the date of such cancellation, or (d) take any other action that would constitute a “repricing,” as such term is used in Section 303A.08 of the New York Stock Exchange Listed Company Manual, in each case other than in connection with a Change in Control or the adjustment provisions set forth in Section 5.7.

2.5 No Dividend Equivalents. Notwithstanding anything in this Plan or an Agreement to the contrary, no Option or SAR shall be eligible to earn dividend equivalents with respect any shares of Common Stock subject to the Option or SAR.

III STOCK AWARDS

3.1 Stock Awards. The Committee may, in its discretion, grant Stock Awards to such eligible persons as may be selected by the Committee. The Agreement relating to a Stock Award shall specify whether the Stock Award is a Restricted Stock Award, a Restricted Stock Unit Award or an Other Stock-Based Award.

3.2 Terms of Restricted Stock Awards. Restricted Stock Awards shall be subject to the following terms and conditions and shall contain such additional terms and conditions, not inconsistent with the terms and conditions of this Plan, as the Committee shall deem advisable.

(a) Number of Shares and Other Terms.The number of shares of Common Stock subject to a Restricted Stock Award and the Restriction Period, Performance Period (if any) and Performance Measures (if any) applicable to a Restricted Stock Award shall be determined by the Committee.

(b) Vesting and Forfeiture.The Agreement relating to a Restricted Stock Award shall provide, in the manner determined by the Committee, in its discretion, and subject to the provisions of this Plan, for the vesting of the shares of Common Stock subject to such award (i) if the holder of such award remains continuously in the employment or service of the Company during the specified Restriction Period and (ii) if specified Performance Measures (if any) are satisfied or met during a specified Performance Period, and for the forfeiture of the shares of Common Stock subject to such award (x) if the holder of such award does not remain continuously in the employment or service of the Company during the specified Restriction Period or (y) if specified Performance Measures (if any) are not satisfied or met during a specified Performance Period.

(c) Stock Issuance. During the Restriction Period, the shares of Restricted Stock shall be held by a custodian in book entry form with restrictions on such shares duly noted. Upon termination of any applicable Restriction Period (and the satisfaction or attainment of any applicable Performance Measures), subject to the Company’s right to require payment of any taxes in accordance with Section 5.5, the restrictions shall be removed from the requisite number of any shares of Common Stock that are held in book entry form.

(d) Rights with Respect to Restricted Stock Awards.Unless otherwise set forth in the Agreement relating to a Restricted Stock Award, and subject to the terms and conditions of a Restricted Stock Award, the holder of such award shall have all rights as a stockholder of the Company, including, but not limited to, voting rights, the right to receive dividends and the right to participate in any capital adjustment applicable to all holders of Common Stock; provided, however, that a distribution or dividend with respect to shares of Common Stock, including a regular cash dividend, shall be deposited with the Company and shall be subject to the same restrictions as the shares of Common Stock with respect to which such distribution was made.